A Straightforward Proposal to Slow Down CRO Inflation And Bring It Closer to Historical Levels —…

Recently there have been growing discussions on CRO token economics. Specifically, a new proposal on Crypto.org’s GitHub discussion page…

Introduction

Recently there have been growing discussions on CRO token economics. Specifically, a new proposal on Crypto.org’s GitHub discussion page recommends a Burning mechanism that would reduce the inflation rate of Crypto.org Chain. The proposal highlighted is of importance for every CRO holder, therefore we’ve put together this article to unpack the details and help everyone grasp the benefits and potential implications of this proposed burning mechanism.

Currently, there are 26 Billion CRO tokens in circulation, with an annual inflation rate of roughly 2.5%. This means that each year, about 646 Million CRO tokens are emitted to circulation.

As pointed out here, daily emissions have increased a great deal from 1 M CRO in March 2021 to 1.74 M CRO currently, primarily as a result of technical improvements that have led to Crypto.org blocks being validated faster (from every ~6.5 seconds then to around 5.1 seconds now).

The proposed mechanism aims to gradually burn a portion of the CRO rewards emitted to the validators. This approach entails allocating a portion of tokens produced through future inflation to a “Community Pool” and then burning the collected tokens on a periodic basis. The anticipated result is a decrease in effective inflation rate, ultimately leading to a more robust CRO token economy.

How does the proposed “burning” work?

Before explaining the burning mechanism, let’s first gain an understanding of how current staking and reward mechanisms work on the Crypto.org chain.

CRO Holders delegate CRO tokens to validators

Validators secure the chain by producing and validating blocks based on the number of staked tokens.

CRO rewards received by CRO holders after deducting Validator Commissions

Validators receive commissions from rewards (subject to validator’s commission rate)

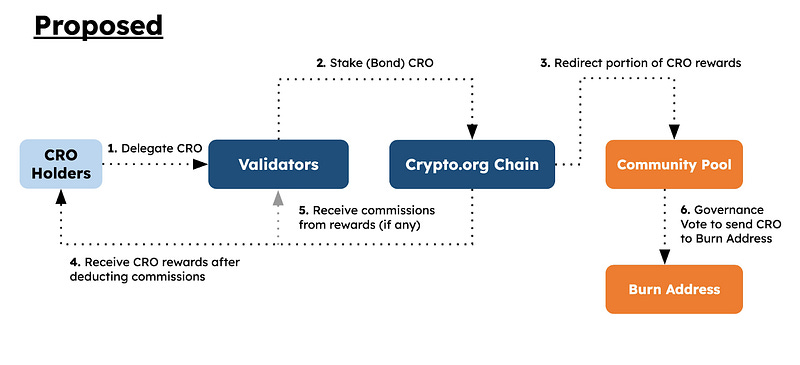

Let’s now take a look at how the proposed mechanism would work.

CRO Holders delegate CRO tokens to validators

Validators secure the chain by producing and validating blocks based on the number of staked tokens.

Instead of directly emitting the CRO fully to the validator, some portion of the rewards (15% as per proposal) are redirected to Community Pool

CRO rewards (minus portion redirected) received by CRO holders after deducting Validator Commissions

Validators receive commissions from rewards (subject to validator’s commission rate)

CRO in Community Fund are sent to Burn Address through governance vote and removed from circulation

What does it mean for CRO holders?

At present, 4.75 billion CRO are bonded, constituting 18% of the total CRO supply. With annual rewards of around 646 million CRO distributed to stakers, the staking APY stands at 13.6%. The proposed burning mechanism is estimated to take approximately 100 million CRO (15% of annual rewards) out of circulation in the first year, reducing the effective inflation rate from 2.49% to around 2.1%. As a result, staking rewards will experience a slight decrease from 13.6% to 11.5%. Despite the reduced staking rewards (in CRO terms), the burning mechanism is designed to enhance the overall token economy by decreasing the circulating supply and selling pressure in the long run.

Path to an “ultra-sound” CRO

The proposal marks an exciting first step towards refining the token economics of CRO and draws inspiration from other established chains such as Cosmos Hub, Osmosis and Ethereum.

For instance, last year Cosmos Hub passed a proposal to increase the community tax rate in order to boost its community pool. Similarly, Osmosis has an ongoing tokenomics upgrade proposal under discussion that entails reducing OSMO token’s inflation rate.

It is crucial to understand that both supply and demand side factors could drive the CRO token’s supply. By focusing on the supply side, the burn proposal would reduce inflation and CRO in circulation, thus increasing the token’s scarcity.

Another approach, which is to burn a portion of transaction fees, could also be considered in the future. However, the transaction fees of the Crypto.org Chain are cheap, which means that Crypto.org Chain generates less than 100,000 CRO in transaction fees annually. Burning transaction fees would have an insignificant impact on the emission rate compared to the proposed burning scheme and its scale of 100M of CRO annually.

Looking ahead, further exploration into the demand side could be experimented. For instance a fee-burning mechanism similar to Ethereum’s EIP-1559 would involve burning a portion of gas fees from Cronos network’s transactions. As Cronos network grows, this mechanism may pave the way not only for a lower inflation of Cronos token, but a potential deflationary point in the future.

What you can do

We encourage the community to actively participate in shaping the future of Crypto.org chain by communicating with your delegated validators and participating in the discussion of the proposal on Discord and GitHub discussion.

If you are a validator, you should actively listen to your delegators opinions before you cast your vote. You may also decide to cast a weighted-vote if there are different opinions across your delegators.

If you are a delegator, if you cannot reach a consensus with the validators you have chosen, you can still cast your own vote to the proposal or you can decide to re-delegate to other validators who share the same goals as yours. You may refer to these guides for Crypto.com DeFi Desktop wallet or Keplr wallet users on how to cast a vote for a governance proposal.

Together, we can create a more vibrant and sustainable token economy that benefits all CRO holders and the broader ecosystem.